Remedy's New CEO: Can a Live-Service Veteran Steer the Studio to Profitable Growth Without Losing Its Soul?

The Financial Crossroads: Why Remedy Needed a New Captain To understand the board’s decision, one must first examine the sobering financial realities that precipitated it. Remedy’s full-year 2025...

The Financial Crossroads: Why Remedy Needed a New Captain

To understand the board’s decision, one must first examine the sobering financial realities that precipitated it. Remedy’s full-year 2025 earnings report presented a tale of two narratives. On one hand, revenue grew healthily to €59.5 million, a 17.5% increase from 2024, buoyed by strong ongoing sales. On the other, the company reported a significant operating loss of €14.9 million. This loss was primarily driven by a non-cash impairment charge related to the underperformance of FBC: Firebreak, the studio’s cooperative multiplayer project.

The situation came to a head in October 2025, when Remedy issued a profit warning to investors, directly linking it to Firebreak's struggles. This event triggered an immediate leadership change, with then-CEO Tero Virtala stepping down. The message was clear: the current trajectory was unsustainable.

Yet, within these challenging figures, glimmers of Remedy’s enduring strength shone through. The studio ended the year with a positive operating cash flow of €4.5 million. Most tellingly, Q4 2025 revenue surged by 46.3% year-over-year to €17.0 million, fueled by royalties from the critically acclaimed Alan Wake 2 and remarkable ongoing sales of Control, which sold 1 million units in 2025 alone following the sequel announcement. The core brand value—the power of its single-player narratives—remained not just intact, but potent. The challenge was converting that creative acclaim into consistent, predictable profitability.

The Strategic Hire: A Resume That Sparked the Panic

Enter Jean-Charles Gaudechon, whose appointment became effective on March 1, 2026. His resume, spanning over 20 years in the industry, reads like a deliberate counterpoint to Remedy’s traditional public image and is the direct source of widespread fan anxiety. His most notable experience comes from a senior executive role at Electronic Arts (EA), where he was responsible for live-service operations and profit and loss (P&L) for major franchises like FIFA Mobile and FC Online.

For the community, the potential red flags extend beyond live-service games. Gaudechon’s more recent background includes leadership roles at sports betting and fantasy sports platforms, having co-founded Sleeper and worked with OneFootball. It is this specific blend of experiences that has fueled fan anxiety over "predatory" monetization, with many fearing that live-service models—complete with battle passes, grinding loops, and intrusive storefronts—will infect Remedy’s narrative-heavy games, sacrificing artistic purity for quarterly earnings.

From the boardroom perspective, however, Gaudechon’s profile offers precisely the skills deemed missing. Remedy Chairman Henri Österlund stated the goal is to achieve "profitable growth," accelerate expansion, and guide Remedy toward greater independence through self-publishing. Gaudechon’s expertise in scaling digital services, managing complex P&L statements, and building long-term, post-launch revenue streams is the exact toolkit for that mission. The hire is a direct, strategic response to the financial pressures laid bare in late 2025.

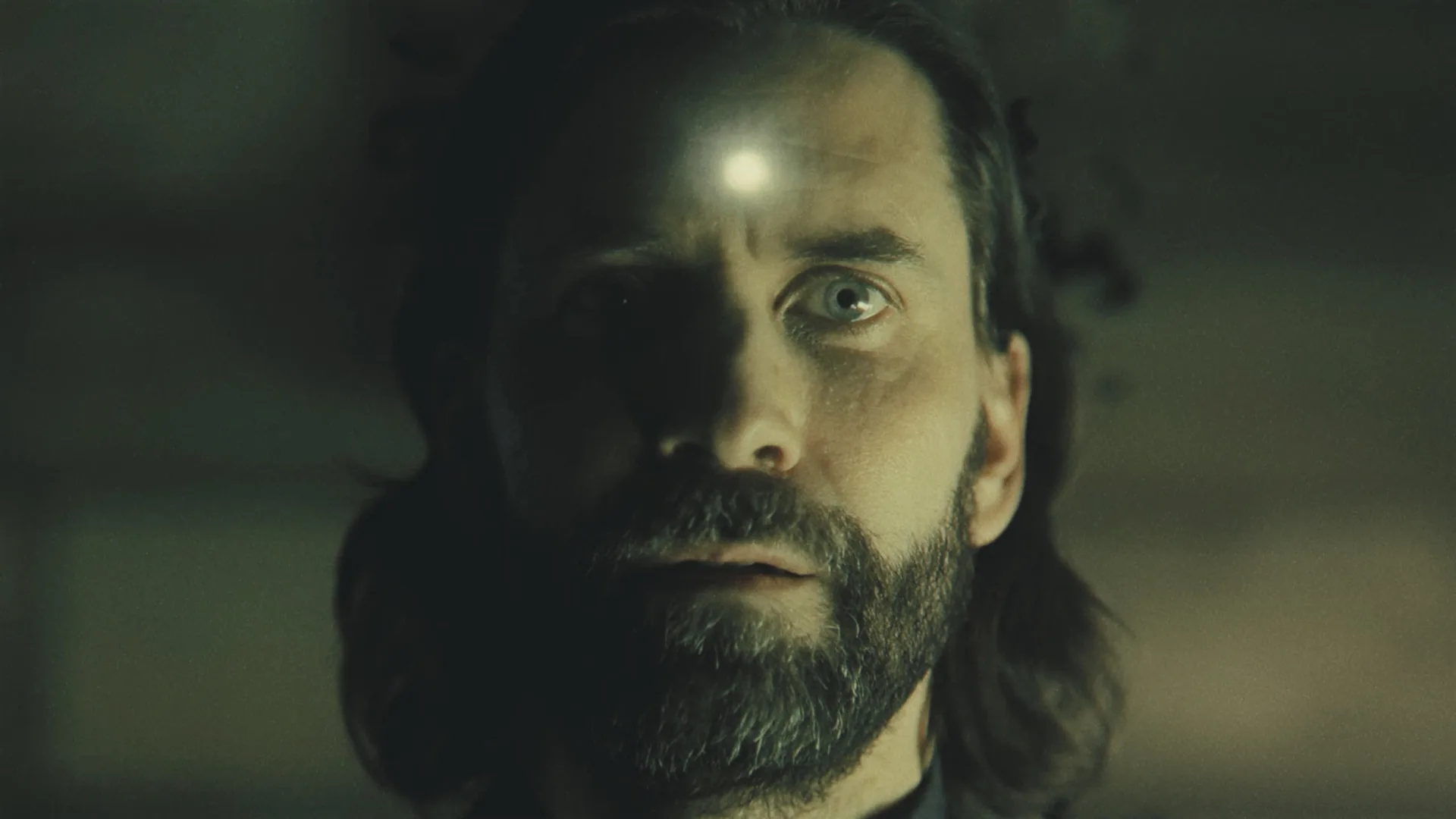

The company’s official communications have carefully framed this transition. Perhaps most crucial for fan reassurance was the public endorsement from creative director Sam Lake, who stated that Gaudechon "very much understands our wildly unique vision." This suggests an internal effort to align the new commercial leadership with the established creative direction, attempting to bridge the palpable trust gap that the online reaction has revealed.

CONTROL Resonant: The First Test of a New Era

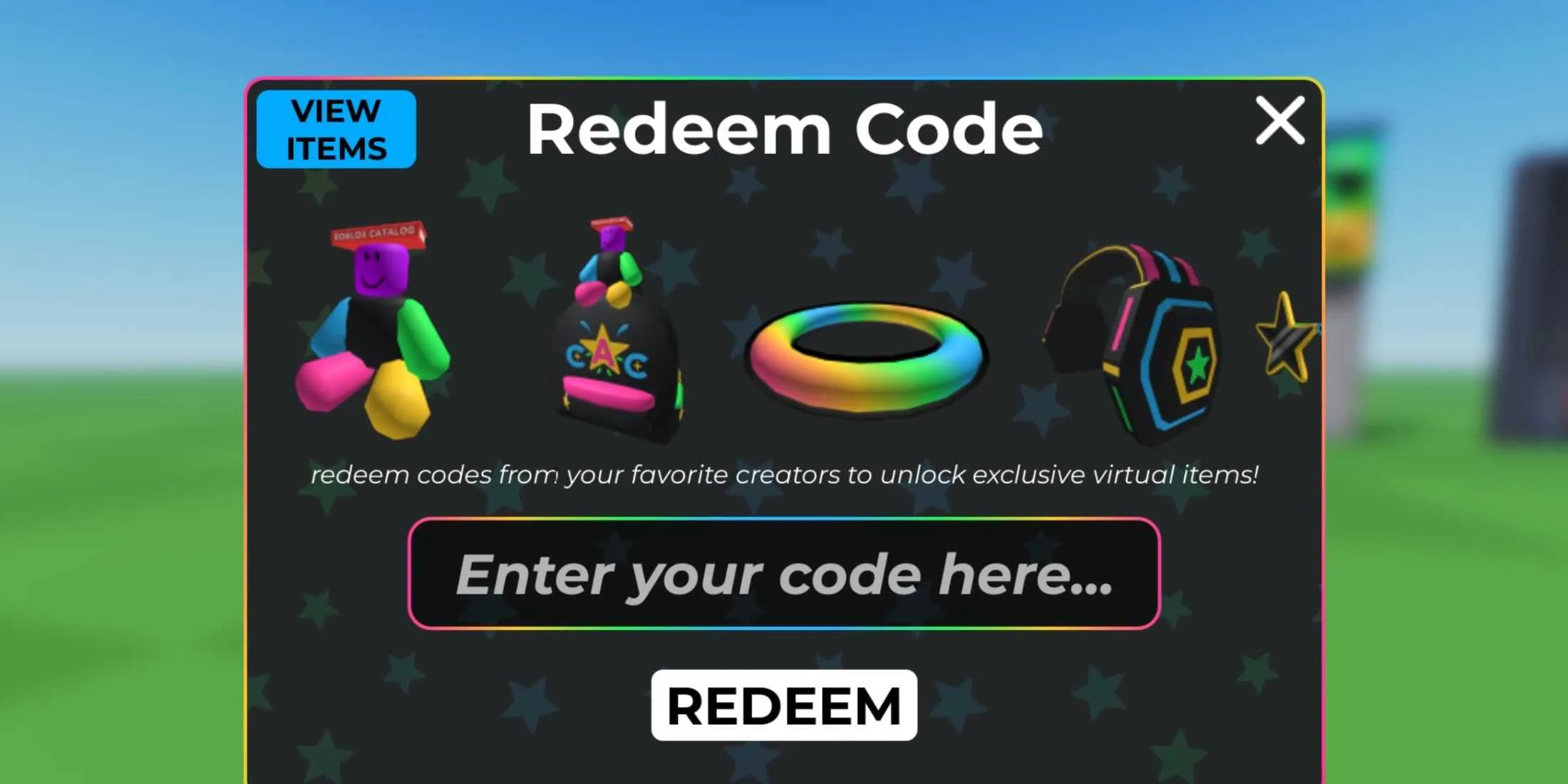

All eyes now turn to the immediate proving ground: CONTROL Resonant, slated for release in 2026. The studio has already billed it as their "most ambitious game to date," and its core development was underway long before Gaudechon’s arrival. Its fundamental vision is likely set in stone.

This makes Resonant the perfect litmus test for the new leadership dynamic. While the core campaign may remain a classic Remedy experience, scrutiny will be intense on everything surrounding it. The game’s business model, its plans for post-launch content, and its DLC strategy will be parsed for the earliest signs of Gaudechon’s influence. Will it be a purely single-player expansion, or will it incorporate cooperative or ongoing service elements hinted at by the Firebreak project? How Resonant is sustained after launch will offer the first concrete evidence of whether this new era represents an evolution or an upheaval.

The Delicate Balance: Business Survival vs. Creative Identity

This tension frames the central challenge: the undeniable business imperative versus the preservation of creative identity. To remain independent and continue funding ambitious, AAA-quality narrative games, Remedy must find a path to sustainable profitability. The question is not necessarily whether “live-service” is a dirty word, but how such models are implemented.

The core challenge for Gaudechon and the studio is to discover if Remedy’s signature narrative depth and atmospheric immersion can coexist with a respectful, player-friendly service model that ensures financial health. They are not without examples to study. Studios like Guerrilla Games have maintained the strong single-player heart of the Horizon series while carefully expanding into a separate multiplayer experience. Insomniac’s Spider-Man titles are commercial juggernauts that have integrated post-launch content without compromising their narrative integrity. The path exists; it is merely fraught with peril for a studio whose identity is so tightly bound to a specific type of experience.

Gaudechon’s hire is a logical, if undeniably risky, response to clear and present financial pressures. His commitment to "protect what makes [Remedy] special" and Sam Lake’s endorsement provide a foundation of cautious optimism. Yet, the ultimate verdict on his tenure will not be found in quarterly reports alone. Success will be a dual metric: delivering the "profitable growth" demanded by the board while honoring the creative covenant with players. The fate of CONTROL Resonant and the studio’s next original IP will render the final judgment. The ultimate test for Gaudechon won't be turning a profit, but proving that profit and soul can resonate on the same frequency.